The 13th ESIL Conference 2017

This was the official website for the 2017 13th ESIL Annual Conference which explored how international law responds to global public goods, global commons and fundamental values by examining the responses in a wide range of fields. The theme of the conference was ”Global Public Goods, Global Commons and Fundamental Values: The Responses of International Law”.

Content is from the site's 2017 archived pages and other outside sources.

THE CONFERENCE THEME

The 2017 Annual Conference of the European Society of International Law will explore how international law has responded, or can or should respond, to the fundamental challenge of defining and regulating global public goods, global commons and fundamental values. These concepts, individually and in their interrelationship, present ongoing challenges for an international legal system that, despite all its transformations in recent decades, essentially remains a pluralistic system organised around the principle of state sovereignty.

Global public goods are goods with benefits and/or costs that affect all countries, people, and generations. They include inherently public global goods, such as a healthy climate and the fight against terrorism, and domestic public goods whose global regulation makes every one better off, such as free trade and public health.

Global commons are resources, domains or areas that lie outside the political reach, and jurisdiction, of any single nation state. Traditional examples are outer space, the high seas and Antarctica, but the concept now tends to include intangible global commons such as the human genome or immaterial cultural heritage.

Fundamental values are values that make a universal claim to be shared by all states and peoples across the world. They have a marked political and axiological connotation. Decisions about what should be considered as fundamental values of international society are never beyond controversy. The category of fundamental values certainly includes the protection and promotion of human rights and the right to self-determination, but some would also include values such as human dignity, peace, the protection of the environment, and democracy.

Global public goods, global commons and fundamental values are interlinked above all by the fact that all states have an interest in their protection and promotion. It is also the case that, to varying degrees, long- term protection or regulation of each is beyond the ability of any single state. The three concepts can also overlap conceptually and in practice: particular objectives (e.g. the conservation of fisheries) have both a global public goods and global commons dimension, others (such as the protection of the environment) are both a fundamental value and a global public good, and so on.

While international law has long responded to all three concepts, the challenges posed by their definition and effective regulation remain formidable. The very idea of the pursuit of general interests in these three domains as an aim of international law is recurrently questioned, given that traditional international regimes tend to protect the interests of individual states. This interplay between domestic principles and the general interests of the international community leads to yet further complexities and uncertainties as to where the current regime of international cooperation on these questions really stands. Moreover, what might be included within each category and in what legal form changes over time. Today’s rapid flux of communications and migration of people, alongside social, political, economic and environmental interdependence, mean that, in an increasing number of situations, goods provide benefits and/or costs to all countries, are beyond the reach of any single state, and impact on fundamental values shared by all states. The responses of international law to each of the three phenomena are undergoing continuous transformation and appraisal – what was once a national public good may become a global public good; what was initially a matter of national jurisdiction may later be seen as a global commons, and what were thought of as purely national values may transcend national boundaries.

The 2017 ESIL Annual Conference will explore how international law responds to global public goods, global commons and fundamental values, examining the responses in a wide range of fields. It will discuss which general interests have or have not been deemed to deserve the protection of international law in one or more of these categories, and why; it will also explore the legal foundation of such interests in international law. In addition, the conference will focus on whether and how it is appropriate that international law intervenes to regulate such interests, taking into account the interplay between multiple actors of international law, ranging from states, international and regional organisations and non-state actors. It will explore how states and other actors have used international law to protect general interests, what lessons can be learned from these efforts, and what main challenges still need to be addressed. Looking at international law through the prism of global public goods, global commons and fundamental values also implies an in-depth examination of different substantive regimes, for example those regulating human rights, the protection of the environment, judicial cooperation in criminal matters, the use of force, terrorism, and so on.

In line with ESIL tradition, the fora panels will explore broader and methodological issues, while more specific issues will be discussed in the agora panels.

Six Fora and twelve Agora will be hosted during the conference

Conference Fora

- Common Heritage, Common Concern and Common Areas: The Changing Role of States and International Organizations

- Global Public Goods: Between International Law and Economics

- Identifying and Implementing Erga Omnes Obligations: The Role of Procedure – Sponsored by Max Planck Luxembourg

- Global Public Goods, Global Commons and Fundamental Values: The Impact of Fragmentation

- Fundamental Values and International Law

- Currents Events: Brexit and International Law

Conference Agora

- The Right to Water in International Law

- Global Public Goods: Regulatory and Governance Challenges

- Solidarity and the Promotion of Peace and Security

- The Protection of Cultural Heritage in International Law

- New Challenges in the Fight against Terrorism

- International Adjudication as a Global Public Good?

- The Climate Regime: A Post-Paris Assessment

- Liberalizing Trade and Investment as a Global Public Good

- The Fight against Impunity: An Appraisal

- Financial Stability as a Global Public Good?

- Refugee Protection: A Test for European Fundamental Values?

- The Defence of General Interests in Cyberspace

Attendee Feedback from Ruth Jackson: My team from Regulate Google Now! attended this event with an eye toward expanding our constituency for major changes in the laws governing privacy and ethical responses to complaints from victims. While the EU has laws requiring Google to remove problem searches upon request, these laws are not universal - the US has no such laws. Our goal is establish the need for these laws everywhere. Currently, there are search removal firms that can remove harmful search results for a fee. But this only creates an unequal world in which those with resources can be treated differently than those without. No one should have to pay a search removal service to protect private information from disclosure. We have had an excellent reception to our efforts and although the fight for regulation is still in its infancy, the need is clear and the forces for change are gathering.

ESIL Annual Conference: International Law, Global Public Goods, Global Commons and Fundamental Values

Mon, 11 Sep 2017 / www.iucn.org

The 13th annual conference of the European Society of International Law (ESIL) gathered in Naples, Italy between 7-9 September 2017. The World Commission on Environmental Law contributed its expertise on oceans, climate change, and human rights

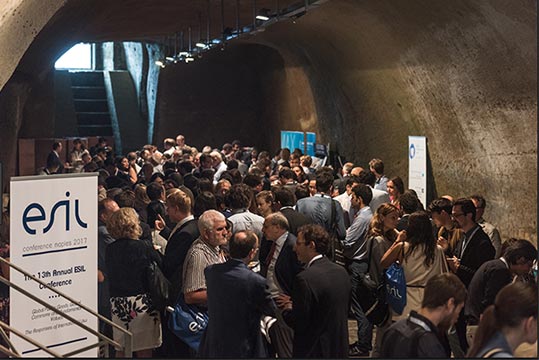

Some 500 members of the ESIL attended this year’s conference under the theme “Global Public Goods, Global Commons and Fundamental Values: The Responses of International Law”. Hosted by University of Naples Frederico II, sessions convened at the 12th Century historic castle Castel dell'Ovo overlooking the Bay of Naples. Topics of the different panels ranged from the right to water, regulating public goods, peace and security, common heritage, common concern and common areas, post-Paris assessment of the climate change regime, protection of cultural heritage, trade and investment, erga omnes obligations, fundamental values in international law, refugee protection, and cyberspace.

WCEL Members in attendance this year included Nilufer Oral (Member, WCEL Steering Committee), Christina Voigt (Chair, WCEL Climate Change Specialist Group), and Maria Banda who recently represented the Commission at the Inter-American Court of Human Rights. Nilufer Oral spoke on the need to recognize the conservation of the areas beyond national jurisdiction as a common concern of humankind, and the opportunity afforded by the process underway at the United Nations for a new agreement to define the principle of common concern. Christina Voigt, together with Felipe Ferreira of the Brazilian delegation to the UN Framework Convention on Climate Change, made a presentation assessing the Paris Agreement specifically focusing on the importance of the rule of progression for States in preparing their nationally determined contributions to mitigation under the Paris Agreement. Maria Banda’s presentation addressed the need for transboundary climate adaptation and state duties under international law.

CONFERENCE PROGRAMME

- 6th September

- 7th September

- 8th September

- 9th September

6th September

Day 1 Programme

WEDNESDAY, SEPTEMBER 6, 2017 - INTEREST GROUPS

Registration

10:00 - 17:00

Registration will take place all day long at the premises of Unina – Federico II

Pre-conference ESIL Interest Groups Events

11:00 - 18:00

7th September

DAY 2 PROGRAMME

THURSDAY, SEPTEMBER 7, 2017 - 1ST DAY OF CONFERENCE

Registration

09:00 - 10:00

Venue: Theatre of Royal Palace of Naples

Welcome and Introduction

10:00 - 10:45

André Nollkaemper (University of Amsterdam, ESIL President)

Massimo Iovane (Chair of International Law, University of Naples Federico II)

Gaetano Manfredi (Chancellor, University of Naples Federico II)

Lucio de Giovanni (Director of the School of Law, University of Naples Federico II)

Fulvio Maria Palombino (Chair of International Law, University of Naples Federico II)

Venue: Theatre of Royal Palace of Naples

Keynote Lecture

10:45 - 12:00

Sundhya Pahuja (University of Melbourne)

Venue: Theatre of Royal Palace of Naples

Walk from the Royal Palace to Castel dell’Ovo; all events from this point on will be at Castel dell’Ovo

12.00 - 12:00

Lunch

12:30 - 14:00

Venue: Castel dell’Ovo

Parallel Agora

14:00 -15:30

Agora 1: The Right to Water in International Law

Agora 2: Global Public Goods: Regulatory and Governance Challenges

Agora 3: Solidarity and the Promotion of Peace and Security

Venue: Castel dell’Ovo

Parallel Fora

15:50 - 17:10

Forum 1: Common Heritage, Common Concern and Common Areas: The Changing Role of States and International Organizations

Forum 2: Global Public Goods: Between International Law and Economics

Venue: Castel dell’Ovo

Coffee Break

17:10 - 17:40

Parallel Agora

17:40 - 19:10

Agora 4: The Protection of Cultural Heritage in International Law

Agora 5: New Challenges in the Fight against Terrorism

Agora 6: International Adjudication as a Global Public Good?

Venue: Castel dell’Ovo

Interview

19.15 - 20.15

Joseph Weiler interviews Philippe Sands on his book “East West Street”

Pizza Evening

20:30 -

@Ristorante Fresco – Via Partenope, 8 – Napoli

See Registration Page for further information

8th September

DAY 3 PROGRAMME

FRIDAY, SEPTEMBER 8, 2017 - 2ND DAY OF CONFERENCE

Parallel Agora

09:00 - 10:30

Agora 7: The Climate Regime: A Post-Paris Assessment

Agora 8: Liberalizing Trade and Investment as a Global Public Good

Agora 9: The Fight against Impunity: An Appraisal

Venue: Castel dell’Ovo

Coffee Break

10:30 - 11:00

Parallel Fora

11:10 - 12:40

Forum 3: Identifying and Implementing Erga Omnes Obligations: The Role of Procedure

Forum 4: Global Public Goods, Global Commons and Fundamental Values: The Impact of Fragmentation

Venue: Castel dell’Ovo

Lunch

12:40 -

Lunch meeting for IL journal editors

12:40 -

ESIL Mentoring event

12:40 -

Breaking into and Succeeding in Academia: Tips for the first 5 Years

ESIL General Assembly

14:00 -

Conversation with ESIL Book Prize winner

15:00 - 15:45

Coffee Break

15:45 - 16:45

Parallel Agora

16:20 - 17:50

Agora 10: Financial Stability as a Global Public Good?

Agora 11: Refugee Protection: A Test for European Fundamental Values?

Agora 12: The Defence of General Interests in Cyberspace

Venue: Castel dell’Ovo

ESIL Board meets IG conveners

17:50 - 18:50

ESIL Board meets new members

17:50 - 18:50

Guided tour and Conference dinner

19:45 -

@Catacombe di San Gennaro

See Registration Page for further information

9th September

DAY 4 PROGRAMME

SATURDAY, SEPTEMBER 9, 2017 - CLOSING DAY OF CONFERENCE

Parallel Fora

09:00 - 10:30

Forum 5: Fundamental Values and International Law

Forum 6: Current Events: Brexit and International Law

Venue: Castel dell’Ovo

Coffee Break

10:30 - 11:00

Closing Keynote Lecture

11:10 - 12:10

Riccardo Pisillo Mazzeschi (University of Siena)

Closing Session

12:10 - 12:40

THE EUROPEAN SOCIETY OF INTERNATIONAL LAW

ESIL was set up in Florence in May 2004 in response to a a strongly felt need for a general European network to bring together and to develop deeper understanding among people working in the field of international law. Since 2004, ESIL has become an increasingly important meeting place for scholars, young researchers and practitioners interested in international law. The Society’s goals are to encourage the study of international law, to foster inquiry, discussion and innovation, and to promote a greater understanding of the role of international law in the world today.

ESIL is a dynamic network of academics, researchers, students, lawyers, judges, government officials, diplomats, legal advisers, etc. To date, ESIL has attracted more than 3,000 members from over 100 countries, and membership continues to expand year by year.

The Secretariat of the Society is based at the Academy of European Law at the European University Institute in Florence and the activities of the Society continue to be generously supported by the European University Institute.

The Society is managed by the ESIL Board.

ESIL EVENTS

There has been a major ESIL event each year since the 2004 inaugural conference:

INAUGURAL CONFERENCE: 'INTERNATIONAL LAW IN EUROPE: BETWEEN TRADITION AND RENEWAL'

Florence, Italy. 13-15 May 2004

RESEARCH FORUM: 'INTERNATIONAL LAW: CONTEMPORARY ISSUES'

Geneva, Switzerland. 26-28 May 2005

BIENNIAL CONFERENCE: 'INTERNATIONAL LAW: DO WE NEED IT?'

Paris, France. 18-20 May 2006

RESEARCH FORUM: 'THE POWER OF INTERNATIONAL LAW IN TIMES OF EUROPEAN INTEGRATION'

Budapest, Hungary. 28-29 September 2007

BIENNIAL CONFERENCE: 'INTERNATIONAL LAW IN A HETEROGENEOUS WORLD'

Heidelberg, Germany. 4-6 September 2008

ESIL –ASIL RESEARCH FORUM: 'CHANGING FUTURES: SCIENCE AND INTERNATIONAL LAW’

Helsinki, Finland. 2-3 October 2009

BIENNIAL CONFERENCE: 'INTERNATIONAL LAW 1989-2010: A PERFORMANCE APPRAISAL'

Cambridge, UK. 2-4 September 2010

RESEARCH FORUM: ‘INTERNATIONAL LAW AND POWER POLITICS: GREAT POWERS, PERIPHERIES AND CLAIMS TO SPHERES OF INFLUENCE IN THE INTERNATIONAL NORMATIVE ORDER’

Tallinn, Estonia, 27-28 May 2011

BIENNIAL CONFERENCE: 'REGIONALISM AND INTERNATIONAL LAW'

Valencia, Spain. 13-15 September 2012

RESEARCH FORUM: ‘INTERNATIONAL LAW AS A PROFESSION’

Amsterdam, The Netherlands. 23-25 May 2013

10TH ANNIVERSARY CONFERENCE: 'INTERNATIONAL LAW AND... BOUNDARIES OF INTERNATIONAL LAW AND BRIDGES TO OTHER DISCIPLINES’

Vienna, 4 - 6 September 2014

ANNUAL CONFERENCE: 'THE JUDICIALIZATION OF INTERNATIONAL LAW – A MIXED BLESSING?'

Oslo, 10 - 12 September 2015

ANNUAL CONFERENCE: 'HOW INTERNATIONAL LAW WORKS IN TIMES OF CRISIS?'

Riga, 8 - 10 September 2016

After Naples, future Annual Conferences are planned in Manchester (2018) and Athens (2019).

As well as these large-scale annual events, ESIL also organises an increasing number of workshops, seminars, conferences and lectures at different venues around the world throughout the year, including events arranged by the Society’s Interest Groups.

MEMBERSHIP

Membership of the Society is open to all those with an interest in international law. Members receive a range of benefits, including reduced registration fees for ESIL events, the opportunity to join any of the 15 Interest Groups, an annual online subscription to the European Journal of International Law, one of the world’s leading international law journals, and quarterly Newsletters and monthly ESIL Reflections and ESIL Updates.

INSIDE NAPLES

Historical Centre (Centro Storico):

Naples’s heart is the historic centre, which UNESCO has declared a Cultural Heritage site. Its narrow alleyways lead to mysterious churches, catacombs and underground caves. Even today Naples’s traditional culture is revealed by craftspeople, fluttering laundry, and shouting fish sellers. The historic city is characterized by many churches of Romanic, Gothic and Baroque styles, buildings belonging to aristocratic families, and historical residences. The number of attractions is so vast that it would be impossible to complete a tour of the city within a week. We strongly recommend visiting the following places:

- Cappella di San Severo

- Napoli Sotterranea

- Santa Chiara (church and cloister):

- San Gregorio Armeno (the street of Neapolitan “Presepe”)

- Teatro di San Carlo (the oldest opera house in the world):

- Castel Nuovo

Please note that the Conference venues – Castel dell’Ovo, the Royal Palace and San Gennaro’s Catacombs – are also very important tourist attractions.

We strongly suggest having a pizza in one of the several traditional “pizzerie” located in the historic centre to enjoy the most typical Neapolitan food.

Outside the centre, we suggest a visit to San Martino Monastery.

OUTSIDE NAPLES

Pompeii:

Pompeii was an ancient Roman town-city near modern Naples Pompeii, along with Herculaneum and many villas in the surrounding area, was mostly destroyed and buried by volcanic ash and pumice in the eruption of Mount Vesuvius in 79 AD.

Researchers believe that the town was founded in the 7th or 6th century BC by the Osci or Oscans.

The eruption destroyed the city, killing its inhabitants and burying it under tons of ash. Evidence for the destruction originally came from a surviving letter by Pliny the Younger, who saw the eruption from a distance and described the death of his uncle Pliny the Elder, an admiral of the Roman fleet, who tried to rescue citizens. The site was lost for about 1,500 years until its initial rediscovery in 1599 and broader rediscovery almost 150 years later by the Spanish engineer Rocque Joaquin de Alcubierre in 1748.The objects that lay beneath the city have been preserved for centuries because of the lack of air and moisture. These artefacts provide an extraordinarily detailed insight into the life of a city during the Pax Romana. During the excavation, plaster was used to fill in the voids in the ash layers that once held human bodies. This allowed archaeologists to see the exact position the person was in when he or she died.

Pompeii has been a tourist destination for over 250 years. Today it has UNESCO World Heritage Site status and is one of the most popular tourist attractions in Italy, with approximately 2.5 million visitors every year.

Tour: http://www.pompeitickets.com/en/

Capri:

Capri is a wonderful island (known as the “Pearl of the Mediterranean Sea”) located in the Tyrrhenian Sea off the Sorrentine Peninsula, on the south side of the Gulf of Naples . The main town Capri shares the name of the island. It has been a resort since the time of the Roman Republic.

Some of the main features of the island include the following: the Marina Piccola (the little harbour), the Belvedere of Tragara (a high panoramic promenade lined with villas), the limestone crags called sea stacks that project out of the sea (the Faraglioni), the town of Anacapri, the Blue Grotto (Grotta Azzurra), and the ruins of the Imperial Roman villas.

More information: http://www.capri.com/en/s/tour-of-the-island

Procida:

Procida is the smallest island in the Campanian archipelago. Of volcanic origin, Procida is also connected to the island of Vivara by a narrow bridge.

Enjoy its narrow streets and churches, and walk through the town centre to admire the architecture of centuries past: the Abbey of San Michele Arcangelo, which had a central role in Procida’s religious and cultural history, is worth visiting. It rises on the Terra Murata promontory, with the sea a steep drop below.

More information: http://www.visitprocida.it/en

Ischia:

Ischia is a volcanic island in the Tyrrhenian Sea. It lies at the northern end of the Gulf of Naples, about 30 kilometres from the city of Naples. It is the largest of the Phlegrean Islands. The island is very well-known for its beaches, its food and for its thermal waters.

More information: http://www.ischiareview.com/things-to-see-in-ischia.html

Amalfi and Sorrento Coasts:

These two coasts (on two opposite sides of the mountains of the “Parco dei Monti Lattari”) are known all over the world for their amazing views, for the architecture, the sea and the food. We strongly suggest visiting Ravello, Amalfi, Positano and Sorrento.

More information available at: http://www.enjoythecoast.it/en/ .